Employer 401(k) matches can light up retirement savings

February 2, 2018

- Most employers contribute to their workers’ 401(k) plans.

- Workers look for matching contributions when they choose where to work and whether to enroll in their workplace plans.

- To encourage all employees to take advantage of the match, focus on its tax-saving benefits and positive impact on the economy.

Having a 401(k) plan with a matching contribution from the employer can be a powerful incentive for workers to participate in plans and a tool to encourage higher savings rates.

A match means more money

An employer match is like free money for a saver. It doesn’t come out of the worker’s paycheck, and taxes are deferred. If the match is invested in one of the plan’s investment options, it can grow over time. A match also becomes a continuing feature of the plan each year, unlike a one-time bonus.

Many employers recognize the benefits of a match. Most companies of all sizes contribute to their employees’ retirement plan either with a match or profit sharing (Deloitte). In its 2016 survey, the Plan Sponsor Council of America found that 83% of plans provide a match based on participant contributions. Of plans with fixed matches, about 39% match 50 cents on the dollar up to 6% of salary, and 35% match dollar for dollar in a range of 4% to 6%. The average company contribution is 3.8%. Recently, some large companies have announced they are increasing their 401(k) matches — arguably one of the best long-term uses for the tax savings companies are already realizing.

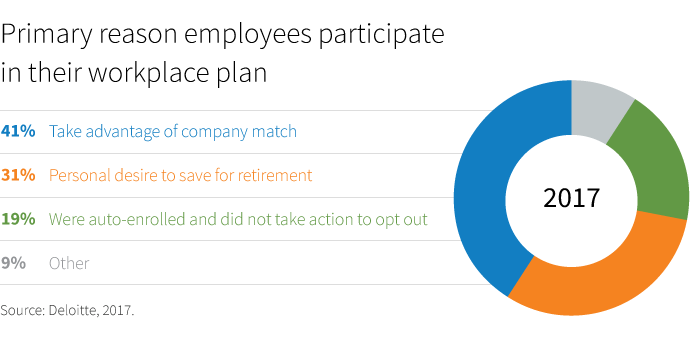

Employees look for matching contributions when enrolling in a workplace plan.

The Employee Benefits Research Institute (EBRI) did a study of workers not currently saving for retirement. They found nearly 73% of workers were somewhat or more likely to save for retirement if their contributions were matched by their employer. (EBRI and Greenwald & Associates, 2017 Retirement Confidence Survey).

Uptake is uneven

Despite the popularity of matching contributions, a large portion of eligible workers may still not be taking advantage of the match. In 2015, Financial Engines reported that 25% of 401(k) participants were not taking full advantage of the employer matching contribution, leaving up to $24 billion annually on the table. On an individual basis, that translated into more than $1,300 each year.

A match can help the capital markets

A matching contribution can also have greater benefits to the economy. Adding to a 401(k) helps to build on the more than $27 trillion in retirement assets held in this country, making more capital available for the creation of new companies and the expansion of established companies. Invested in stocks, bonds, and other assets, these funds fuel capital markets and spur economic growth.

Growing savings is the bottom line

It’s wise for employers to help workers save for retirement. It’s also important for our national economy. Today, workplace savings plans channel hundreds of billions of dollars into productive capital investment each year. And my sense is that nations that successfully mobilize the savings of their entire workforce, and direct those savings into dynamic securities markets, will enjoy a growing competitive advantage in the 21st century.

309926