Automatic features jumpstart retirement savings

January 11, 2018

- Only 57% of U.S. employers automatically enroll workers in a workplace plan. (PSCA)

- Without auto-features, just 44% of participants have savings rates of 10% or more. In plans with auto-enrollment, that total rises to 67%. (DCIIA)

- Recently introduced legislation would require all employers to offer workplace savings.

With the flurry of data that people need to process on a daily basis, it’s easy to understand why inertia is one of our biggest challenges, especially when making decisions about money.

Still, avoiding action on some financial decisions, such as saving for retirement, can undermine future income.

Behavior is a major driver of success

In the early days of the 401(k), as workers took on more responsibility for initiating saving and making investment choices, it soon became evident that some of the biggest obstacles to success were rooted in their own behavior.

Given the choice to sign up for a 401(k), some workers delayed the decision or did not opt in. Without guidance, some made decisions by following the crowd rather than seeking expert advice. Risk aversion, overconfidence, and attempts to time the market led many investors to make allocations that too often delivered more losses than gains.

During the development of the 401(k), many in the industry turned to research around behavioral finance to understand how to improve the system. Behavioral researchers and authors Dr. Richard Thaler and Cass Sunstein found that putting saving decisions on autopilot can help individuals overcome lack of willpower and inertia. Their research supported auto-enrollment and auto-escalation of deferrals. Ultimately, automatic design became a cornerstone of the game-changing Pension Protection Act of 2006. The work of these researchers also led to their groundbreaking book, Nudge, in 2008, and a Nobel Prize in Economics for Dr. Thaler in 2017.

Even more recent research builds support for a combination of automatic plan design features to help improve participation and contribution rates. The Defined Contribution Institutional Investment Association reported that with access to auto-escalation, most contributors raised deferral rates by one percentage point each year. Among plans without auto-features, only 44% had savings rates of 10% or more. For plans with auto-enrollment, 67% had savings rates of 10% or more. Among plans with both auto-enrollment and auto-escalation, 70% were saving 10% or more of income.

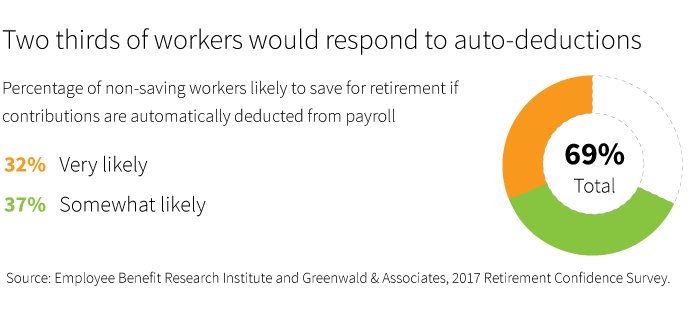

In a 2017 report, the Employee Benefit Research Institute found that most workers not currently saving were more likely to save for retirement if their contributions were automatically deducted from payroll. A multiyear analysis by Empower Retirement, the Lifetime Income Survey, also points to significant income replacement capacity when workers have access to a plan with auto-features. While the average individual in the most recent survey was on track to replace 62% of income, the addition of auto-enrollment and auto-escalation, and working with an advisor, boosted that replacement rate to 100% of current salary.

Access and leakage challenge the system

Despite the progress made, more than 40 million workers still do not have access to workplace savings. This is particularly problematic for members of the so-called “gig economy,” a mobile workforce of freelance and contract workers. This growing segment, which may comprise 40% of the workforce by 2020 (Intuit), could have difficulty saving enough for retirement without guidance and additional savings vehicles. Many workers also lose savings momentum when they change jobs and cash out of a 401(k) plan or forget about the assets, leaving these savings outside of their long-term investment plan.

Adoption of automatic design is not as widespread as it could be. While nearly 67% of large plans (5,000 or more participants) have adopted auto-enrollment, among employers overall just 57% automatically enroll workers. Even among large plans, barely 22% include auto-escalation.

Finally, while the average deferral rate has risen to 6%, some plans may be automatically enrolling participants at a starting rate of just 3%, without any auto-escalation. The origin of this practice emanated from early guidance from the Treasury in the late 1990s, which was meant merely as a starting point.

A good place to start the next chapter

Much of the success we have seen to date has resulted from public policy decisions grounded in solid research. I believe policy is also going to need to play a significant role in improving our national retirement system. We must extend workplace savings to all workers, require all plans to utilize a full-automatic design, and set a 10% or higher deferral rate as the new industry standard.

Recently introduced legislation in the House may be a good place to start the next chapter of the 401(k). The Automatic Retirement Plan Act of 2017, introduced by House Ways and Means ranking member Richard Neal, would require all employers to have a workplace retirement plan. To assist businesses in achieving this goal, the bill exempts certain small employers and new businesses, and offers tax credits for companies with less than 100 employees.

Certainly there are voids in the retirement system that need to be filled, but these challenges can be met today if we have the political will to get it done.

309570