Could a full-auto 401(k) plan drive millennials to save more?

September 20, 2017

- Many millennials, who could benefit from long-term market gains for retirement, lack access to a tax-advantaged workplace savings plan. (Pew Research)

- Millennials face more debt than previous generations, including billions in student loans.

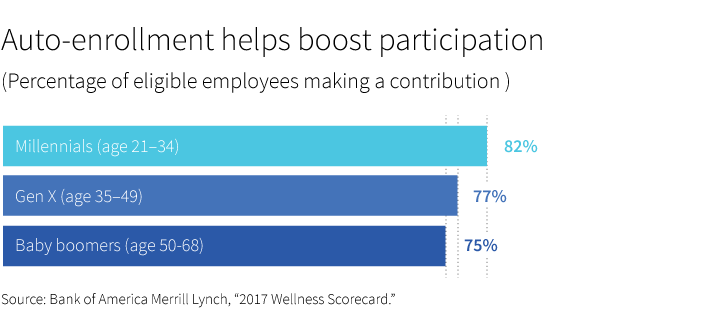

- Auto-enrollment has raised the 401(k) participation rate among millennials to levels higher than boomers. (BofA Merrill Lynch)

Millennials may feel time is on their side when it comes to saving for retirement. After all, there is plenty of time to save and change course, if necessary, before reaching age 65. But this generation — defined as those born between 1982 and 2004 — may also face some of the biggest challenges to saving.

Still, even obstacles can be overcome.

For those with access to a workplace retirement savings plan, research has shown that plan design can help more millennials start saving for retirement earlier in their careers, making the most of their long investment horizon before retirement. With some modifications, automatic plan features may help them save more.

Environment shapes behavior

Millennials have lived through some extraordinary investment periods that likely influence their savings behavior. Consider their impression of investing after living through two market downturns, the dot.com crash of 2000, the housing crash, the Great Recession of 2008, and the slow economic recovery. It’s not surprising that some studies have found that millennials are skittish about investing their savings, especially in stocks.

They also face a unique set of challenges to saving:

- Millennials have more debt than previous generations at their age, including student loans. Borrowers under the age of 30 represent 30% of total student debt.

- Millennials have less access to workplace savings plans than baby boomers.

- Even when they have access to a 401(k), millennials are less likely to participate if given the opportunity to choose. (Pew Research)

Today’s retirement savings experience also differs from that of older workers. Pension plans are disappearing, and most millennials will spend their entire career saving for retirement through an employer-sponsored defined contribution plan. With that comes an increased responsibility for decisions around retirement.

Youth has some advantages

It’s not completely an uphill battle for this generation. Millennials, on average, are the most educated generation. They also, among others, stand to inherit $30 trillion in wealth from older generations over the next three decades.

Many millennials are starting to save and invest early. Most 401(k) plans offer mutual fund investments. In fact, IRAs and defined contribution plans invest nearly $8 trillion in mutual funds — representing 30% of the retirement savings market. Boomers began buying mutual funds in their 30s, according to the Investment Company Institute. For Generation X (those born between 1965 and 1984), the median age was 27. But millennials began buying mutual funds on average at age 23.

Auto-enrollment can help millennials

In a recent study, Bank of America Merrill Lynch found that auto-enrollment lifts 401(k) participation among all ages, particularly millennials. More millennials — 82% — contributed to a workplace plan than Gen X (77%) or boomers (75%). The report also noted that older millennials (ages 28 to 34) were more likely to participate in a retirement plan than younger millennials (ages 21 to 27) — 60% versus 38%. But once auto-enrollment is introduced, participation jumped to 78% among younger millennials and 88% in the older group.

Automatic features are effective in general

With the success demonstrated by auto-enrollment, plan sponsors may want to consider going further. Other automatic features, such as auto-escalation, can help savers reach higher levels of saving.

Research points to consistent saving and deferring 10% or more of current income as key drivers to help meet savings goals and income needs in retirement.

We can take retirement savings to the next level

Over the past three decades, we have learned a lot about what works. The Pension Protection Act of 2006, which enabled plan sponsors to introduce a range of automatic design features, was a turning point for workplace savings. This revolution in retirement savings demonstrated the power of a fully automatic plan design.

We have the potential to increase savings for millennials — and workers of all ages — if we expand on what’s working.

We can dramatically improve retirement saving

All stakeholders have a role.

- Congress can pass legislation that provides access to workplace savings for all workers, and close the access gap once and for all. Several proposals have already been introduced, including the creation of an auto-IRA offering for all workers.

- Industry has increased adoption of auto-features such as auto-enrollment for years. The next step is a wider adoption of auto-escalation, with a new standard deferral rate of 10% or more.

- Regulatory changes may be needed to require the adoption of a “full-auto” plan design as the system-wide norm.

We have the opportunity to dramatically improve retirement saving in the United States, focused on the needs of today’s largest generation — millennials. To do that, we need support and action from policymakers and the public to get the job done.

308197